You can’t stop a natural disaster from occurring, but you can prepare your home and reduce damage risk. In honor of National Preparedness Month, we’ve put together a list of ways to get your home disaster-ready.

The U.S. has the most extreme weather in the world and over the last five years, all 50 states have issued disaster declarations. This means that no matter where you live in the U.S. disaster preparedness is required.

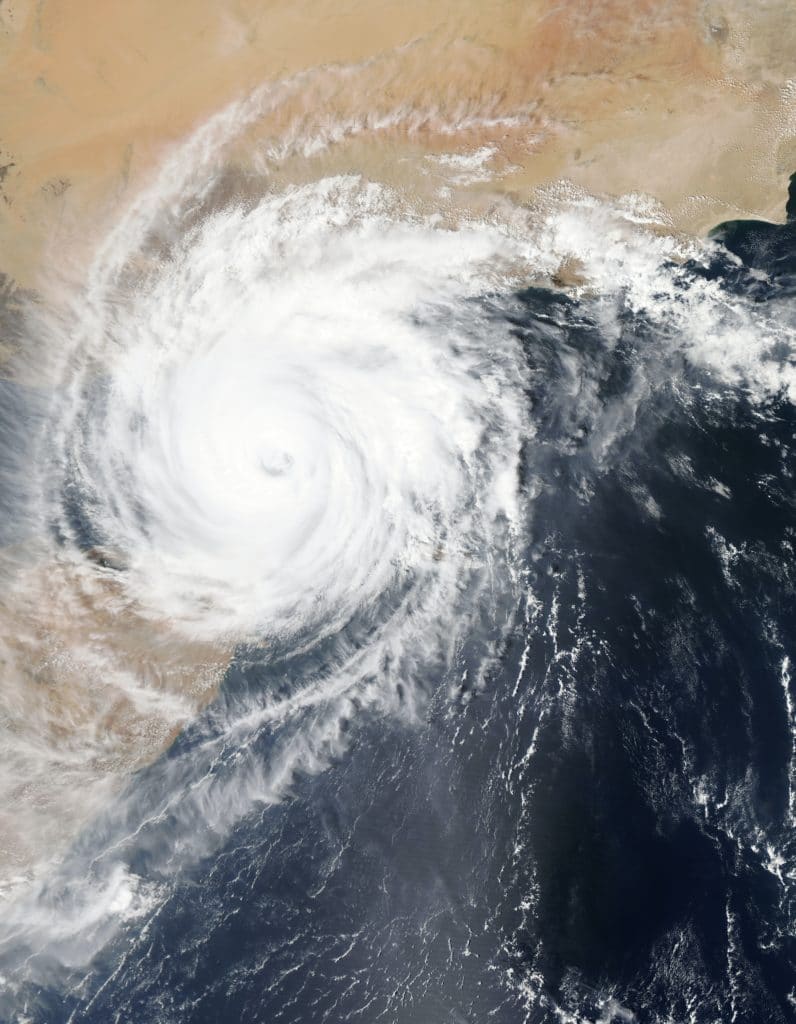

Of course the region where you live impacts the type of disaster that may occur. You won’t experience a hurricane out west (unless you go all the way west to Hawaii) but you will be more prone to wildfires, mudslides and earthquakes. In the Midwest, prepare yourself for flooding and tornado risks.

Three in four Americans worry that their home may be damaged by a disaster this year. Here are some tips to get your residence ready:

How to protect your home

We can’t change the weather, but we can take steps to protect ourselves and our property when a disaster is on the way. Sometimes, you will have days to prepare for an impending disaster but other times, you might not be so lucky. Tornadoes and fires are just two examples of major disasters that can appear unexpectedly, unlike hurricanes which give more advanced warning.

Remember that preserving life comes first, because items can always be replaced. Following evacuation procedures from your local officials will help keep your family safe.

Here are some tips to protect your belongings:

1. Set money aside in an emergency fund

Having extra funds at the ready makes evacuating less stressful, since you won’t have to worry about cost when making plans. It’s a good idea to have six months of income set aside in an emergency fund (although this much in savings isn’t always possible). If you can’t afford a six month supply of cash in your emergency fund, opt for three months instead.

In normal circumstances, it’s good to take out cash when a named disaster is heading your way but with the novel coronavirus in 2020, some businesses are no longer accepting cash. Cashless payment is now seen as less risky and more widely accepted, so have both on hand for purchases made on the go.

2. Keep an emergency preparedness kit onsite

Prepare for the worst by keeping a stocked emergency kit onsite. This kit should be able to last your family 72 hours without electricity. If you do evacuate, bring the emergency kit along with you so you have it on hand.

It will also be important for you to have a way to receive updates even when the lights cut off. A portable charger can help keep your phone alive, and a portable radio will allow you to tune into news radio throughout the disaster event.

Another thing to remember is that if you have kids, you’ll need a way to entertain them as you wait for safety. This will help them get through the disaster with less stress, and it will also give you more time for actionable decision making. Pack games, crossword puzzles, and other entertainment to quell the boredom.

Here are more items the Red Cross recommends keeping in your emergency kit.

3. Install recommended safety features

Be sure to purchase and maintain popular safety features so your home has an extra level of protection when disaster strikes. Some popular safety features include hurricane shutters, a fire extinguisher, smoke and carbon monoxide detectors, and fire sprinklers.

This step also includes installing temporary disaster-specific safety features, such as sandbags to prevent flood water from getting in. Flooding brings multiple risks into your home and flood waters can be extremely deadly. Gas lines can become exposed and begin to leak if a home sustains major damage. This can become an extremely hazardous situation.

In addition to utility, installing these features can also keep your insurance policy up to date and save you on monthly coverage costs.

4. Ensure your policies are up to date

Did you know that you can’t purchase insurance once a named disaster is heading your way? Planning ahead can save you a ton of cash, so always make sure that your home insurance is up to date but beyond that read the fineprint.

Many traditional home insurance policies actually require you to purchase additional insurance, such as flood insurance, in order to be fully covered when disaster strikes. Do research on what natural disasters are likely to occur in your neighborhood so you know what additional insurance is needed.

5. Have an evacuation plan for you and your pets

Lastly, and most importantly, you need to have a safe place for you and your family to go to should you need to leave your home behind. Whether you’re evacuating 50 miles to 500 miles, you should have a list of safe places to go before a disaster is named.

Many local hotels and shelters don’t accept pets so if you do have a furry friend at home, make sure to have special accommodations for them or find somewhere pet-friendly for the whole family to go to.

States most at risk for natural disasters

While a natural disaster can happen anywhere, there are areas that are particularly prone to them. Below, we analyzed data from FEMA over the last five years to see where disasters occurred most frequently, and what type of disaster impacted each state.

Small-scale weather events happen all the time (such as Hawaii experiencing 100 M-3 level earthquakes a year), but if a natural disaster is declared, it means federal funds were brought in to address the crisis. National aid is granted when major events happen.

From 2015–2019 these states issued the most disaster declarations:

- California: Unless you’ve been living under a rock, you’ve probably heard about California’s wildfire problem. Over the last 5 years 84 disaster declarations have been declared across the state, nearly three times the amount of any other state. Unsurprisingly many of these declarations were fire-related. The Camp Fire in 2018 was the deadliest and most destructive in the state’s history. Another fire that same year burnt Miley Cyrus’ house down in Malibu.

Other disasters that impacted the state included an earthquake, along with severe storms, flooding and winter storms.

- Washington: The west coast is a fire hotspot, and the Evergreen State is no exception. Washington comes in second place for disaster declarations, issuing 30 over the last five years. Like California, most of these disasters were fire-related, although they also saw flooding and snowstorms.

- Oklahoma: A famous stop on tornado alley is Oklahoma, but it’s actually the fires that happen more frequently here. Thirteen disaster declarations related to fire have been issued from 2015-2019. Tornadoes are still a major risk in the area as well and in 2019, Oklahoma sadly set the record for most tornadoes ever recorded in a single year.

- Oregon: Fires in the west are a common theme on our list and the state of Oregon is no exception. The most common disaster declaration in Oregon over the past five years was fire: the state issued 19. The state also saw 4 snowstorms and 1 severe storm that needed federal aid assistance.

- Texas: Texas is no stranger to natural disaster declarations, in fact, it is the state most prone to all-hazards (and expensive home insurance policies). It has its unique geography to thank for this variety of disasters: hurricanes, tropical storms, fires, severe storms, tornadoes and winter storms have all impacted the state over the last five years. Hurricane Harvey is the second most damaging hurricane following Hurricane Katrina.

Climate change is making disasters more frequent, and more dangerous when they occur. Extreme risk mitigation efforts will need to be taken in the years to come to preserve property and human life. Migration out of particularly hazardous areas may be required, especially for flood prone areas in Florida and wildfire hotspots in the west.

This risk assessment is something to consider when purchasing a home as you may lose the ability to insure your asset over time if disasters worsen as predicted. This means that if your home is to burn down, and you weren’t able to obtain home insurance, you would have to replace your home and everything inside it out of pocket.

Today, these disaster-related perils are covered by standard home insurance policies:

- Fire

- Lightning

- Weight of ice, snow and sleet

- Windstorms and hail

- Volcanic eruptions

- Falling objects

- Water damage unrelated to flooding

- Freezing of household systems

To learn more about the frequency of natural disasters and which states have paid the most for damage, check out this visual from The Zebra below.